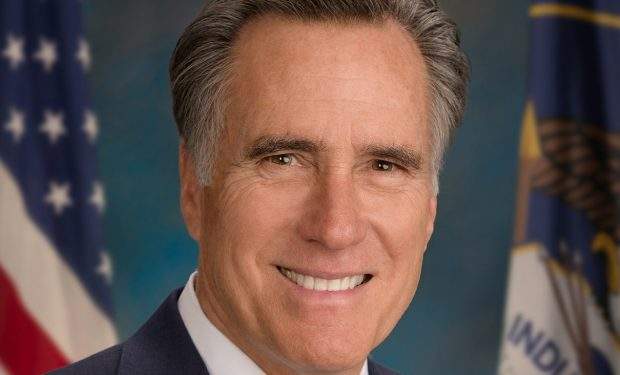

Sen. Mitt Romney issued a series of tweets about the failure of Silicon Valley Bank and the actions the federal government needs to take to help its depositors. Romney wrote that a rescue failure would have “extreme” consequences.

Romney is unambiguous about the potential ill effects of the government’s failure to act: “The federal government must act immediately to assure depositors at SVB and at regional and local banks everywhere that their deposits are completely safe. The immediate and long term consequences of failure to do so could be extreme.”

The federal government must act immediately to assure depositors at SVB and at regional and local banks everywhere that their deposits are completely safe. The immediate and long term consequences of failure to do so could be extreme.

— Mitt Romney (@MittRomney) March 12, 2023

In an earlier declamation, Romney sternly assessed who the losers should be in the fiasco, writing: “Silicon Valley Bank’s shareholders and executives lose it all, as they should.”

Silicon Valley Bank’s shareholders and executives lose it all, as they should. Depositors in good faith, however, should recover and have access to their deposits in order to meet their payrolls, pay their suppliers, and to prevent contagion.

— Mitt Romney (@MittRomney) March 11, 2023

But Romney — a former private equity titan who knows banking and lending better than nearly any of his Senate colleagues — was careful to clarify that “depositors in good faith” must be protected and have their funds restored.

Romney speculated that if those bereft depositors, often small businesses that need working capital to meet payroll and satisfy vendors, aren’t made whole though government aid that a system-wide “contagion” could be the result.

That contagion includes a fiscal virus best described as a crisis of confidence. Without confidence in the local and regional banks, Romney wrote in a subsequent tweet, depositors across the country will move their deposits to a “handful of NYC money center banks.”

Regional & local banks are critical to starting & supporting small businesses of all kinds. If depositors that account for most or much of these banks’ capital are afraid that they can lose their deposits, depositors will move their capital to a handful of NYC money center banks.

— Mitt Romney (@MittRomney) March 12, 2023

[Note: Money Center banks raise most of their funds from the domestic and international money markets, relying less on smaller depositors for funds. The top four U.S. banks by size, all money center banks, are JP Morgan, Bank of America, Citigroup, and Wells Fargo. Investopedia explains that the borrowing and lending activities of money center banks tend to be “with governments, large corporations, and regular banks.” They are less likely to lend to and hold deposits for your favorite local bakery.]

The Senator from Utah implies that such a concentration of nationwide deposits in four or five New York-based banks would be dangerous for the economy, because “regional & local banks are critical to starting & supporting small businesses of all kinds.”

Depositors who are “afraid,” Romney says (and bank failures are pretty good at producing fear) will gut the local and regional banking systems by pulling their funds.